Tax season is something you probably don’t look forward to. It’s like diving into mathematics, documentation, and understanding the year’s tax regulation and changes. Whether you’re resolving to cut your 2020 tax bill or save more for retirement in the new year, it’s time to start planning. Once you turn 50, you can qualify for extra tax breaks. Older people get a bigger standard deduction and they can earn more before they have to file a tax return at all. Workers over 50 can also defer or avoid taxes on more money using retirement and health savings accounts.

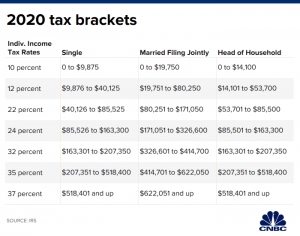

Here are 2020′s individual income tax brackets:

Here are some ways to save money on taxes as you age.

Standard deduction for seniors: If you don’t itemize your tax deductions, you can claim a larger standard deduction if you or your spouse is age 65 or older. The standard deduction for seniors is $1,650 higher than the deduction for people younger than 65 who file as individuals.

Married couples can increase their standard deduction by $1,300 if one member of the couple is 65 or older and $2,600 if they’re both at least age 65.

If you are legally blind, you can take an additional deduction. If you or your spouse is legally blind, you can also add $1,300 to your standard deduction. If you are both legally blind, you may deduct an additional $2,600. If you are legally blind and unmarried, you can deduct an additional $1,650.

You must turn 65 by the last day of the tax year, but here’s a catch: The IRS says you actually turn 65 on the day before your birthday. If you were born on January 1, you would qualify as of December 31—just in the nick of time to claim the extra deduction for that tax year.

Higher tax-filing threshold: People age 65 and older can earn a gross income of up to $13,850 before they are required to file a tax return for 2019, which is $1,650 more than younger workers. The tax filing threshold is $27,000 for couples both age 65 and older .

Property tax breaks: Property tax rules vary considerably by state and local jurisdiction. But in some places, people who are above a certain age and who also earn below a specific income level qualify for property or school tax deferrals or exemptions.

Additional IRA deduction: Workers age 50 and older can contribute an additional $1,000 to an IRA, or a total of $7,000 in 2020. A 50-year-old worker in the 24% tax bracket who maxes out his IRA would save $1,680 on his current tax bill, $240 more than the maximum possible tax break of $1,440 for a younger retirement saver in the same tax bracket.

401(k) catch-up contributions: Older workers with access to a 401(k) plan may be eligible to make catch-up contributions. Employees age 50 and older can defer paying income tax on $6,500 more than younger workers if they contribute that amount to a 401(k) plan, or a total of $26,000.

Qualified charitable distributions: Retirement is a time many people think about giving back to their community by making charitable contributions.If you donate property other than cash to a qualified organization, you may generally deduct the fair market value of the property. If the property has appreciated in value, however, you may have to make some adjustments.

However, if you donate a car, boat, or airplane, your deduction generally is limited to the gross proceeds from its sale by the charitable organization. This rule applies if the claimed value of the donated vehicle is more than $500.

Retirees are typically required to withdraw money from traditional retirement accounts and pay the resulting income tax bill. However, if you don’t need the money, you can avoid income tax on withdrawals from traditional retirement accounts if you make a qualified charitable distribution. Retirees ages 70 and older who transfer any amount up to $100,000 directly from their IRA to a qualified charity will not owe income tax on the transaction.

Free tax help The Tax Counseling for the Elderly program provides free tax assistance to those age 60 or older. IRS-certified volunteers assist older taxpayers with basic tax return preparation and electronic filing between Jan. 1 and April 15 each year.

Life events affect senior citizens’ tax situation:

- Retirement

- Adopting

- Caring for a grandchild

- Selling a home

REFERENCES:

- “Everything you need to know to help save on taxes on 2020,” CNBC, Darla Mercado, 27 November, 2019,

https://www.cnbc.com/2019/11/27/everything-you-need-to-know-to-help-save-on-taxes-in-2020.html - “Tax Breaks for Seniors,” Nation,

https://www.nation.com/tax-breaks-for-seniors/ - “The Best Tax Preparation Option for Senior Citizens,” TaxSlayer, 27 December, 2019,

https://www.taxslayer.com/blog/best-tax-preparation-option-for-senior-citizens/ - “Tax Breaks for Senior and Retirees,” the balance, Beverly Bird, 14 January, 2020,

https://www.thebalance.com/tax-breaks-for-seniors-and-retirees-4148392